| about us | ||

| our role | ||

| our affiliates | ||

| news | ||

| wood pellet | ||

| reach us |

London, 13 July (Argus) — Biomass co-firing projects are the biggest winners in the Netherlands' first SDE+ subsidy auction round this year, with projects totalling 492.1MW of capacity awarded €1.5bn ($1.6bn) in funding.

German utility RWE has been awarded two tranches amounting to €1.2bn over eight years for its 600MW Amer 9 co-firing combined heat and power (CHP) unit and French utility Engie has been awarded €296mn for its 724MW coal-fired Rotterdam plant, also for eight years.

RWE said in June that it had been granted SDE+ subsidies to co-fire up to 50pc biomass at Amer 9 for eight years from 2017. The firm may apply in future rounds for further SDE+ subsidies to increase the proportion of biomass to be co-fired, it said in June. Wood pellet demand would be around 1.2mn-1.4mn t/yr when co-firing at 50pc, it said.

Amer 9 has been converted to co-fire biomass, and can start up relatively quickly, but the utility will await a government decision regarding the proposed early closure of the plant, by 2020, in order to reduce greenhouse emissions. A decision is expected in the autumn.

Engie was not immediately available to comment on its plans for the Rotterdam plant, but a conversion to co-fire biomass could take about 18 months once a final investment decision has been taken, market participants said.

The co-firing projects awarded account for about 40pc of the 25 petajoules of renewable energy that the Dutch government aims to generate with biomass co-firing to help meet 2020 clean energy targets, economic affairs minister Henk Kamp said.

Dedicated biomass heat and CHP plants gained €999mn in subsidy awards spread across 83 projects with a combined capacity of 474.1MW. These could potentially be fuelled by wood chips, wood pellets, wood waste or other waste, market participants said. The biomass gasification sector has been awarded €348.5mn for eight projects with a combined capacity of 75.1MW, largely to be supplied by waste wood or other waste.

The three biomass-fuelled sectors accounted for €2.84bn of the €4bn SDE+ subsidies available in this year's first round, or 71pc of the funding. Geothermal, solar, onshore wind and solar thermal projects were awarded €1.16bn between them.

A second SDE+ auction round is planned for the autumn and funding has been increased to €5bn from a previously planned €4bn, Kamp said. The budget for the second round was increased after the first round was greatly oversubscribed, with €8.2bn of projects put forward for a budget of €4bn.

The autumn auction will be open on 27 September-27 October and, like the first round, will have four phases — for projects seeking up to €0.09/kWh, up to €0.11/kWh, up to €0.13/kWh and up to €0.15/kWh.

Kamp expects SDE+ funding in 2017 to be "similar" to that available this year, but will confirm the exact amount at the end of this year. An evaluation of the efficiency and effectiveness of the SDE+ scheme is under way, and the results will be available at the end of this year.

------

Market consensus yesterday was that this is a hopeful sign for the market, but not yet supporting the forward curve as:

a) Some expected Dutch demand has been priced in already from 2018 onwards and;

b) There is still some uncertainty around the projects and timelines, given the unclear Dutch coal strategy.

november 2015: Global adoption of SBP will aid biomass industry

London, 4 November (Argus) - The biomass industry should push for the Sustainable Biomass Partnership (SBP) to be adopted beyond Europe, Drax head of biomass procurement Deborah Keedy said at the Wood Pellet Association of Canada conference in Halifax, Nova Scotia, today.

SBP was developed by a consortium of European utilities - French energy firm Engie, UK's Drax, Denmark's Dong Energy, German utilities Eon and RWE and Swedish state-controlled utility Vattenfall. But it has so far not attracted the attention of non-European utilities. South Korean and Japanese utilities could have the potential to adopt SBP, Keedy said, but the industry should push for adoption globally.

"The more successful SBP is, the more successful the industry will be," she said.

The industry has long looked for standardization in the market to help increase liquidity. The SBP was introduced to develop a single sustainability framework that could ultimately replace companies' individual certification schemes.

Utilities see the SBP as a tool to help show the market the sustainability of biomass feedstocks.

october 2015: Italy may reverse wood pellet VAT rise

London, 19 October (Argus) — A move by the Italian government to increase value-added tax (VAT) on wood pellets to 22pc from 10pc was a "mistake" that the government intends to correct, prime minister Matteo Renzi said.

News that the government may reverse its wood pellet VAT rise was welcomed by market participants today. Traders had been concerned since the start of this year that the VAT rise would weigh on wood pellet boiler usage, at a time when the market is already oversupplied. Italy increased VAT on wood pellets to 22pc from 1 January.

The increase stemmed from the government's decision to exclude wood pellets from their previous taxation bracket of 10pc - a level that still applies to other wood fuels, such as firewood. Italian bioenergy association AIEL has lobbied the government this year to reduce the VAT increase, noting that the rise "could not have come at a worse time" after two mild winters.

The full effect of the increase is not yet evident, but it is "one more factor" that could impact the market, AIEL said, noting that it could deter consumers from switching to pellet boilers. The VAT rise, a fall in fossil fuel prices and an overhang of supply because of a mild winter in 2014-15 have all weighed on residential pellet consumption, prompting AIEL to recently cut its forecast for 2015 wood pellet use to 2.6mn t.

The wood pellet industry has been up against a "big and strong lobby of heating oil and LPG", in its efforts to secure the reversal of the VAT increase, AIEL consultant Annalisa Paniz said.

october 2015: Dutch increase 2016 renewables budget

London, 14 October (Argus) — The Dutch government has massively increased the budget for next year's SDE+ subsidy scheme to support renewable energy in the country. The increased budget gives hope that more than one biomass co-firing project can obtain approval next year, traders said.

The SDE+ scheme will have two tender rounds in 2016. The first round in March will havea budget of €4bn ($4.6bn), followed by a second round in September that will have a similar budget, the Dutch economic affairs ministry said. The budget is more than double the size of this year's budget, which stood at €3.5bn. The adjustments to the scheme are in an effort to meet the government's goal of 14pc renewable energy by 2020, the ministry said. Italy increased VAT on wood pellets to 22pc from 1 January.

september 2015: The 2015 USIPA’s 5th Annual Exporting Conference

Tiago Andrade, Founder and Director of Wood Pellet Services, our European Affiliate, will be a speaker at the The 2015 USIPA’s 5th Annual Exporting Conference, September 20 - 22 , Miami Beach , USA.

For details: The 2015 USIPA’s 5th Annual Exporting Conference

april 2015: ARGUS European Biomass Trading Conference Presentation by Tiago Andrade, Director of WPS - April 14 - 16, 2015 (Source: Our European affiliate: Wood Pellet Services)

Commonalities, Differences and Interplay between the Industrial and Premium Pellet Markets...For the PDF copy of the full presentation by Tiago Andrade, Director of WPS at the ARGUS European Biomass Trading Conference - April 14 - 16, 2015, please follow the link below:

Presentation - PDF: ARGUS European Biomass Trading Conference Presentation by Tiago Andrade

march 2015: ARGUS European Biomass Magazine's Interview with Tiago Andrade, Director of Wood Pellet Services (Source: Our European affiliate: Wood Pellet Services)

The interview conducted by ARGUS with Tiago Andrade, Director of Wood Pellet Services, our European Affiliate in March of 2015. For the complete interview in the PDF format, please refer to the following link:

Interview: ARGUS European Biomass's Interview with our European Affiliate, Tiago Andrade, Director of Wood Pellet Services

february 2015: The IBERIAN Wood Pellet Market Overview (Source: Our European affiliate: Wood Pellet Services)

Over the past ten years Iberian wood pellet production has grown from zero to approximately 1.5Mt/y. The total installed production capacity in the region now exceeds 2Mt/y, and annual production is typically around 1.1Mt from Portugal and 0.4Mt from Spain. The wood species used for pellets in Iberia is Pine (principally Pinus pinaster together with some Pinus pinea). Eucalyptus, acacia, oak and cork are also regular components in the final pellet feedstock mix...

For the full report: The IBERIAN Wood Pellet Market Overview

january 2015: Upcoming 2015 ARGUS European Biomass Trading, April 14 - 16, London, UK

It is with great pleasure to announce that Tiago Andrade, the Director of European Affiliate Wood Pellet Services, will be a speaker at the upcoming 2015 ARGUS European Biomass Trading , April 14 - 16 , London , UK conference.

To schedule a meeting with one of Wood Pellet Services delegates at this event, please visit: Wood Pellet Services - Conference

december 2014: Wood Pellet Market Outlook 2015 (Source: Our European affiliate: Wood Pellet Services)

The Wood Pellet sector continues to grow rapidly. Increased production (particularly in North American) coupled with rising residential and industrial demand, means that the market has developed some liquidity thereby approaching real commodity status...

For the full report: Wood Pellet Market Outlook 2015

may 2014: EIA: U.S. wood pellets doubled in 2013 due to European demand (Source: U.S. Energy Information Administration, published on Biomass Magazine)

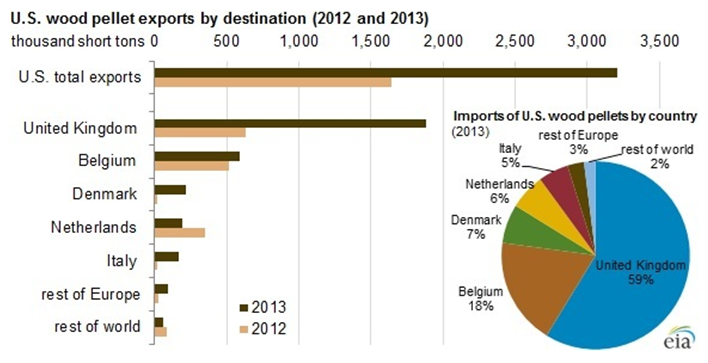

Wood pellet exports from the United States nearly doubled last year, from 1.6 million short tons (approximately 22 trillion Btu) in 2012 to 3.2 million short tons in 2013. More than 98 percent of these exports were delivered to Europe, and 99 percent originated from ports in the southeastern and lower Mid-Atlantic regions of the country.

|

|

Wood pellets are traditionally manufactured from wood waste (including sawdust, shavings, and wood chips) that results from wood processing activities, but they can also be produced from unprocessed harvested wood (generally at a higher cost). Wood pellets are primarily used as a residential heating fuel in the United States, but wood pellets can also be used for commercial heating and power generation applications. As recently as 2008, the U.S. Forest Service estimated that approximately 80 percent of U.S. wood pellet production was consumed domestically. However, because of strong demand growth in Europe, wood pellet exports have been the driving factor in the growth of domestic wood pellet production in recent years.

Growth of U.S. wood pellet exports has been concentrated in southeastern states, which have advantages in terms of abundant material supply and relatively low shipping costs to Europe. Transportation cost is a large part of the total cost of wood pellets; for example, according to Bloomberg New Energy Finance, transportation accounted for a quarter of the delivered price of wood pellets from the Southeast to the Netherlands in mid-2013. Shipping costs generally increase with distance, so the proximity of the United States to Europe compared to wood pellet manufacturers in Brazil and western Canada provides a pricing advantage for U.S. wood pellet exporters.

European countries, particularly the United Kingdom, are using wood pellets to replace coal for electricity generation and space heating. A principal driver in market activity is the European Commission's 2020 climate and energy package, binding legislation enacted in 2009 that implements the European Union's 20-20-20 targets. The 20-20-20 targets have three individual goals for 2020: to reduce EU greenhouse gas emissions by 20 percent from 1990 levels, to increase the renewable portion of EU energy consumption by 20 percent, and to improve EU energy efficiency by 20 percent.

In 2013, the top five importing countries of U.S. wood pellets exports were all European: the United Kingdom, Belgium, Denmark, the Netherlands, and Italy. The United Kingdom accounted for the majority (59 percent) of U.S. wood pellet exports, and more than tripled its imports from the United States between 2012 and 2013.

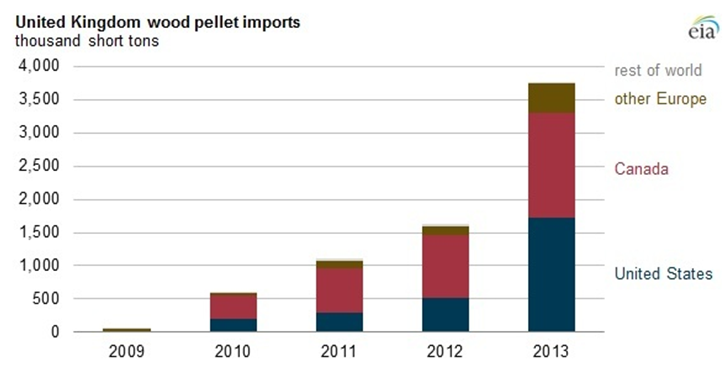

The United Kingdom's wood pellet imports from all sources have grown from near zero in 2009 to more than 3.5 million short tons in 2013. Because of the United Kingdom's Renewables Obligation program, the operators of several large coal-fired power plants have either retrofitted existing units to cofire biomass wood pellets with coal or have converted to 100 percent biomass. The Drax power plant—rated at nearly 4,000 megawatts and the largest coal-fired power plant in the United Kingdom—is in the process of implementing plans to convert half of its six generating units to run solely on wood pellets. The first of these three units entered service in 2013, while the remaining two conversions are planned for completion in 2015. According to Eurostat, the United Kingdom is also a major importer of wood pellets from Canada and, to a lesser extent, from other European sources. Until 2013, Canada was the primary source of the United Kingdom's import supply.

for pdf version of the article including the graphs and external links: U.S. wood pellets doubled in 2013 due to European demand

april 2014: Global pellet market to reach $9 billion by 2020 (Source: By Sue Retka Schill (sretkaschill@bbiinternational.com), published on Biomass Magazine)

The global market for pellets is expected to double in the next seven years, growing from a $4 billion market to $9 billion, Michele Rebiere with Viridis Energy Inc. told attendees at the Pellet Supply Chain Summit, March 24. The summit preceded the International Biomass Conference being held March 24-27 in Orlando, Fla.

Speaking in the closing panel of the day, Rebiere said the largest market, by far, is the European, with 20 million metrics tons (mmt) used in 2013 for both industrial power and residential heat. That is forecast to grow to 28 mmt by 2015 and 42 mmt by 2020. The North American market, is now at 4 mmt and forecast to be 5 mmt in 2015, but she added, are understated going out further. "I think the forecast in North American will increase substantially," she said added, as the interest in cofiring with coal is likely to increase which the forecasts won’t include until projects are announced. The Asian market is expect to grow as well, from 1 mmt in 2013, to 3 mmt in 2015 and potentially 7 mmt by 2020. While the power market is the largest market contributor, the heating market is growing rapidly. Italy, in particular, garnered attention with the doubling of its demand in one year.

Seth Ginther, executive director of the U.S. Industrial Pellet Association, was a bit more conservative on his growth projections, pointing out that 2020 estimates range between 25 mmt and 70 mmt. "I think that 2013 was the year we’re beginning to see where the market is going to shake out. It’s going to be more like the 25 mmt level, but that still is going to be significant."

In his discussion on the changes in the United Kingdom’s incentives, Ginther said it is important to note that the incentives for biomass conversions are aimed at helping develop infrastructure. And, as the carrot is phased out, the stick – the price of carbon – is being increased, making it very expensive to burn coal. As a result, UK power producers are expected to continue to move towards biomass.

As a large UK buyer of North American pellets, Richard Peberdy, vice president of sustainability for Drax Biomass International, outlined his company’s commitment to biomass power and its interest in sustainability. The UK power producer has experimented with a number of biomass sources to supplement coal since 2008, making a commitment to pellets to provide a large portion of its biomass needs. It has two pellet facilities under construction in Mississippi and Louisiana and is building a port facility in Baton Rouge, La.

The first of three boiler conversions has been completed at Drax, with the second to be brought into service later this year and the third planned for 2015. Peberdy reported that Drax was pleased with the performance of its first biomass boiler conversion at the end of the first year of operations. "It's outperformed our expectations in the first year at 39 to 40 percent efficiency on 100 percent biomass." That is significant, he added, because UK sustainability reports projected biomass power would only reach 25 percent efficiencies, much lower than coal power’s average 35 percent efficiency.

Peberdy described Drax’s commitment to sustainability, pointing out that the company established its own sustainability goals even prior to the development of UK standards. The pressure for sustainability brings benefits, he said, by increasing investments in forests, in outreach to forest owners and in safer and better systems for making, handling and moving pellets.

Ben Conte, renewable energy sales manager for Bridgewell Renewables, filled out the panel at the summit on market energies by describing the work his company has done in marketing pellets in the EU. Much of the Bridgewell’s focus has been on meeting the high quality heating market, working to help its customers with their branding efforts. While Bridgewell is developing a brand to be able to meet spot markets, much of the work it’s done has been in seasonal 3-6 month contracts as well as long term contracts for one or two years. "The market is evolving," he said. "The industrial and residential markets are linked in Europe and Asia," he added, and are getting more sophisticated.

Other panels during the day included industry speakers addressing forestry ownership implications, sustainable forest management, pellet mill design considerations and infrastructure.

for pdf version of the article: Global pellet market to reach $9 billion by 2020

march 2014: A Giant Step (Source: By Tim Portz (tportz@bbiinternational.com), published on Biomass Magazine)

The pellet industry will grow by nearly 33 percent during the next two years, as foreign demand drives investment in new capacity and distribution infrastructure.

More than 4 million metric tons of new wood pellet production capacity are currently under construction throughout North America, over 3 million tons of which are scheduled to come on line this year, and 600,000 tons by spring. Such capacity growth is unprecedented in the North American pellet industry, which is comprised of some 160 facilities, with a total installed capacity of around 13 million metric tons. Not only will the capacity added this year grow the industry’s output by nearly 25 percent in just one year, but facilities scheduled to come on line in 2015 will bring the two-year expansion closer to 33 percent.

While unprecedented within the pellet sector, this kind of monumental growth is not without antecedent in the broader renewable energy sector. In 2007 and 2008, the ethanol industry grew from around 6.5 billion gallons of production capacity to over 9 billion gallons. By 2009, the industry had brought on line enough production capacity to achieve over 10 billion gallons of production in the industry’s history.

While growth in the ethanol industry’s construction capacity was characterized largely by the construction of scores of facilities with similar capacities, growth in the pellet sector is largely coming from the construction of a much smaller fleet of supersized plants. Whereas the average installed capacity in the pellet industry’s existing 159 operational plants is under 80,000 tons per year, the planned capacity at the production facilities scheduled to come on line in the next two years is 350,000-plus metric tons per year.

Experienced Producers, New Capacity

The vast majority of under-construction capacity is represented by producers already engaged in pellet production. ––Fram Renewable Fuel LLC, Enviva LP, German Pellets GmbH, Drax Biomass, and Zilkha Biomass Energy––developers who are engaging in follow-up efforts to add to their existing capacities. Still, there are plants under construction that represent a company’s first production effort. Vulcan Renewables, with an initial planned capacity of nearly 150,000 metric tons, is Vulcan’s first facility.

Christopher Kim, president, acknowledges that Vulcan’s facility isn’t coming on line without tremendous input from experienced vendors like pellet mill manufacturer Amandus Kahl, or his more experienced colleagues. “Industry leaders such as Harold Arnold of Fram and Ken Ciarletta of Enova, back when he was with Georgia Biomass, gave us valuable advice that really helped. Being able to go to these veterans for advice when you are just coming online is priceless for a startup [company] like ours,” says Kim.

Vulcan’s planned capacity is unique amongst the projects currently being built. The veterans, alongside whom Kim and other newcomers are building capacity, come from an anchor of experienced producers with nearly 2 million tons of North American production capacity already to their name. And while Drax—with more than 1 million tons of capacity under construction—has no current North American capacity, the company built, owns and operates a 100,000-ton-per-year pellet facility just down the road from its massive power station in Yorkshire, England. This facility in the town of Goole converts mostly straw and energy crop inputs into pellets, leaving Drax atop a very short list of producers with deep experience processing those feedstocks.

Drax Moves Upstream

Drax will not have to rely upon straw or miscanthus inputs for either of its production facilities in the U.S. The two facilities under construction near northern Louisiana’s Bastrop, and Gloster, in southeast Mississippi, are being built in robust wood baskets. While the United Kingdom-based power producer’s foray into U.S.-based pellet production may have surprised some, Drax saw it as a part of a natural progression to become the world’s largest producer of biomass-derived power.

"A secure supply chain is key to Drax’s biomass strategy to become a predominantly biomass-fueled provider of renewable power," notes Matt Rivers, director of fuel procurement at Drax. "It was evident that investment was needed throughout the entire supply chain. The self-supply of some proportion of the needed biomass makes good business sense if Drax is to secure the total volume required to fuel three converted units at Drax Power Station."

Construction of the two facilities began in the second half of last year and both are scheduled to come on line in 2015, with the Amite BioEnergy facility in southwestern Mississippi scheduled to begin operations during the first quarter, and Morehouse BioEnergy facility in the second quarter. The Drax team will draw on both the experience of building the pellet facility in Goole and continued capital projects at the power station to guide them as they select technology vendors to establish their pellet production facilities stateside. “Although not at the scale of those being built in the U.S., much experience was gained through constructing and operating that [Goole] plant to make us well-placed to select the right partners to work with,” says Rivers.

Repurpose on Purpose

The Drax production sites, a welcome addition to the job-hungry rural communities in which they are being built, are both greenfield construction sites with ready access to both abundant feedstock and robust existing and planned freight infrastructure at the Port of Baton Rouge.

Other producers have shown an appetite for acquiring cast-off forest product facilities or the abandoned efforts of earlier pellet developers. Two facilities currently under construction by Rentech Inc. are both conversions of decommissioned Weyerhauser fiber mills in Ontario, Canada. The German Pellets Louisiana facility under construction near LaSalle, La., is a conversion of a previous fiberboard facility, and the Zilkha Biomass-Selma facility was purchased out of bankruptcy in 2010 from Dixie Pellets.

For pellet production newcomer Ren-tech, these reclamation efforts are just one piece of a carefully executed strategy that aligns existing production resources of opportunity, the right supply chain expertise and exclusive port infrastructure with an executed off-take agreement with a creditworthy buyer. The majority of the planned capacity of both Rentech’s Wawa and Atikokan production facilities is already spoken for in two separate offtake agreements. Virtually all the production at Wawa will make its way to the boilers at Drax’s power station, and 45,000 tons of production at Atikokan will stay in Ontario, feeding the recently converted Ontario Power Generation station in Atikokan.

To Market, To Market

For pellet producers, brownfield redevelopment offers a number of advantages, including built-in access to vital transport and shipping infrastructure. Virtually all of the pellets produced by the facilities being built in the next two years will be burned in foreign boilers. As a result, well-considered and cost-effective pathways to ports are crucial. In many instances, producers are also making investments in infrastructure at the ports their pellets will move through.

In the case of Vulcan Renewables, production capacity will come on line before ports are ready to handle the new volume. Until the Port of Jacksonville is ready to handle and load pellets into bulk cargo vessels, Vulcan Renewables will utilize an interim shipping strategy of filling shipping containers and loading pellets onto container vessels the plant is capable of loading.

The output from Fram’s Hazelhurst, Ga., facility will move through the Port of Brunswick, which handles the production from its Appling County facility. Pellet storage and handling services at the Port of Brunswick are handled by Montreal-based stevedoring company Logistec. Recognizing the existing channel depth would eventually create a bottleneck, the Georgia Ports Authority recently added six feet of depth to the shipping channel, which will allow a larger class of bulk vessel to berth and take on these new tons.

Looking Forward

The massive capacity build-out the ethanol industry experienced in 2007 and 2008 was marked by a relatively abrupt slow-down, and just three short years later, the number of ethanol plants under active construction was less than 10. The installed capacity began to equal, roughly, the size of the mandated market and groundbreakings naturally slowed to a trickle.

The funnel of pellet production projects under development but not yet under active construction numbered as high as 27 facilities with more than 7 million tons early last year. As the industry continues to grow, however, questions about the resiliency of this marketplace momentum are beginning to surface. The required volume from U.K.-based power producers is significant, but the risk of having demand tied up in one or two planned facilities is already apparent. In December, the conversion of the massive Eggborough Power Station, which would have created another infusion of Drax-like demand, was omitted from a list of projects deemed provisionally affordable. Stakeholders are already working to get the Eggborough conversion back on track, but demand volatility of this sort is certain to impact the development of projects not yet underway. Eggborough’s fate will have little bearing on the production class of 2014, however, and regardless of demand trajectory at the year’s conclusion, it will go down as a year of unprecedented expansion in the biomass industry’s hottest sector.

for pdf version of the article: A Giant Step

march 2014: An Austrian Lesson in Market Development (Source: By Tim Portz (tportz@bbiinternational.com), published on Biomass Magazine)

Last week I was fortunate enough to travel to Wels, Austria for the European Pellet Conference which is co-located with the World Sustainable Energy Days. The trip was an illuminating one on multiple fronts, but largely I think the experience helped me understand the opportunity for industry growth that can be offered by the robust deployment of residential pellet heat.

In Austria, a country roughly the size of Maine but with over 8 million residents, nearly half of the homes are heated by wood pellets. As a result, Austria is a global leader in the development and production of pellet appliances. Conference organizers report that nearly 25% of the pellet appliances sold in Europe are manufactured in Austria. While growing the pellet market one residential appliance at a time is a far cry from converting massive coal-fired power generation plant to wood pellets in terms of the actual rate of growth, it does work.

Consider Italy. Annalisa Paniz from the Italian Agriforestry Energy Association connected Italy’s growing pellet consumption with the widespread deployment of pellet appliances there. She reported that Italy’s pellet consumption now exceeds 3 million tons annually and is growing at nearly a 10% clip each year. Why? Because pellet stoves are increasingly popular. There are roughly 2 million pellet stoves in Italy, to say nothing of the 200,000 installed pellet boilers in that country.

At first glance, this type of pellet usage would seem to generate a market for relatively localized producers only. Closer inspection though shows Italy imports a large share of the pellets it consumes and Italian production is actually going down. In fact, Paniz reported that there are North American pellets being burned in Italian pellet stoves. Our recently completed annual pellet plant data outreach effort here at Pellet Mill Magazine would certainly confirm that with four different facilities identifying Italy specifically as a marketplace they sell into.

Probably UK policy makers envisioned a scenario not unlike Italy when they built and signed into law their Renewable Heat Incentive (RHI). The RHI would pay homeowners and businesses a feed-in tariff for heat produced by renewable sources, including pellets. In an intentionally humorous presentation delivered by UK wood fuel distributor Edward Billington, he outlined the frustrations of seeing a favorable piece of legislation languish on its slow road to implementation. While the RHI has been signed into law, the program is not currently open to homes and the only guidance from the Department of Energy and Climate Change is that the announcement of the program will come out in the spring of this year. At this point in the presentation Billington raised his eyebrows, looked at his watch and got a hearty chuckle from the audience.

Is the UK the next Italy? If the policy has the effect its authors intended, will that mean increased opportunities for North American producers. It is hard to see how it wouldn’t. Pellet heat will never enjoy the market penetration in the United States that it does in Austria or Italy. Not in my lifetime anyway. That doesn’t mean that growing the residential market in places where it makes sense deserves anything less than our best efforts. We need to continue to advocate and push for policy parity for biomass thermal energy in North America, at every scale.

for pdf version of the article: An Austrian Lesson in Market Development

february 2014: France and Germany Forge Joint Position For 2030 (Source: By Valerie Flynn (valerie.flynn@haymarket.com), published on ENDS Europe DAILY, Friday 21 February 2014)

French president François Hollande and German Chancellor Angela Merkel have pledged to form a united front in favour of a 40% CO2 cut and an EU renewables target of at least 27% for 2030.

But a joint decision adopted by the two countries' governments this week stops short of calling for binding national renewable. Member states' sovereignty over their energy mixes should be fully respected, and support mechanisms will have to be progressively harmonised, the document points out.

Negotiations on the EU's climate and energy package should be concluded by the end of this year at the latest, the two member states said. With many countries not in favour of the 40% goal it looks increasingly likely that agreement on 2030 targets will not be reached at next month's EU leaders' summit.

Both countries want the current carbon leakage list to remain in place until 2020 to help the competitiveness of European industry. The 40% target must be accompanied by a "credible system" of protection for energy-intensive sectors, they said.

They want to see a post-2020 EU framework for energy efficiency, including financial instruments for its promotion, but did not call for any specific target.

At talks in Paris on Tuesday, the two countries agreed to establish a high-level working group for co-ordinating their renewable energy policies.

They will work together to get as much progress as possible on the financial transaction tax proposal before the European Parliament elections. France wants the 11 countries that plan to introduce the tax to earmark revenues for climate finance.

february 2014: Germany's RWE 'very positive' about UK Lynemouth coal-to-biomass conversion (Source: London (Platts) posted by our European affiliate: Wood Pellet Services)

RWE's plans to convert its 400-MW Lynemouth power station in Northumberland, England from coal to biomass are unaffected by subsidiary RWE Innogy's decision to exit its biomass activities, two company spokesmen told Platts Friday.

On Thursday, RWE Innogy's Chief Operating Officer Paul Coffey told journalists that the renewable division planned to focus on onshore and offshore wind and hydro in the period 2014-16.

"Biomass is no longer seen to be a core technology for RWE Innogy," spokesman Stephen Thomas told Platts Friday. "We will be pulling back on our biomass activities, but that is within Innogy -- Lynemouth is not part of Innogy, it is part of RWE Generation."

For the full report: Germany's RWE 'very positive' about UK Lynemouth coal-to-biomass conversion

february 2014: The Market for Wood Pellets in the Benelux (Source: USDA Foreign Agricultural Services posted by our European affiliate: Wood Pellet Services)

Differences in production and consumption characterize the European pellet market. The market can be divided in three regions:

1- The market around the Baltic Sea, with Sweden as major producer and consumer, and Russia as major supplier.

2- The market in Central Europe, with Germany, Austria and Italy as both major producers and consumers.

3- And thirdly, the North Sea region, with the Netherlands, Belgium and the UK as major consumers without any significant domestic production.

The Dutch, Belgian and UK market are dominated by large-scale power plants, and mainly depend on imports from the United States and Canada. The ports of Rotterdam, Antwerp, Ghent and Delfzijl are anticipated to serve as a major logistical hub for the Benelux biomass market and potentially for other regions in the EU. To facilitate the trade in biomass, Endex Wood Pellets, the world’s first industrial wood pellet exchange was established in 2011, and is located in Amsterdam.

The market potential based on policy incentives

According the Renewable Energy Action Plans (NREAPs) which were submitted by the Member States to the EC, a major part of the renewable energy will be produced from biomass. See for more information the chapter about the EU wood pellet sector in the FAS EU Biofuels Annual. In the NREAPs of the Dutch and Belgian government, the targets for the use of biomass for electricity and heat are reported. Considering an energy content of 4.8 GW per MT of wood pellets and assuming the use of biomass other than wood pellets will stagnate, the Benelux wood pellet consumption in 2020 is calculated by FAS The Hague at about 2.7 MMT in the Netherlands and about 3.0 MMT in Belgium, see the graph below. Based on this scenario, nearly three quarter of the pellets are anticipated to be used for the generation of electricity, nearly a quarter for heating and cooling purposes by the private sector, and about 5% for heating purposes by households. In order to fulfill the Green Deal in which the Dutch sector set a target of 10% co-firing of biomass between 2012 and 2015, a volume of about 2.8 MMT of wood pellets is needed (based on a caloric value of 0.41 toe per MT of wood pellets).

The anticipated supply and demand in the Benelux countries until 2020

Since 2008, the demand for wood pellets has significantly outpaced domestic production in Europe. This has resulted in increased imports from the United States. Currently, the United Sates is the main supplier of wood pellets to the EU as well as to the Benelux market. Other significant exporters of pellets to the EU are Canada and Russia. In 2012, U.S. wood pellets exports to the EU are forecast to be close to 2 MMT, which is approximately 40% of the EU import share, representing a value of US$ 360 million. Industry sources expect this trade flow to increase to over 5 MMT in 2015. U.S. wood pellet exports to the Benelux market are forecast to be about 1.25 MMT in 2012 (US$ 225 million).

Based on the Dutch and Belgian NREAPs, FAS The Hague made the following forecast for the production, supply and demand of wood pellets in the Benelux countries. This scenario is taking into account an energy content of 4.8 MWh per MT of wood pellets and the assumption that use of biomass other than wood pellets will remain constant. The trade in 2010 and 2011 is based on HS code 44013020, and on HS code 440131 beginning 2012. The tables also include the consumption of wood pellets based on the private sector’s investment plans for the conversion and construction of power plants.

For the full report with detailed analysis: The Benelux Market for Wood Pellets

january 2014: The 2014 market outlook (Source: our European affiliate: Wood Pellet Services)

2013 turned out to be a "game changer" year, as the Industrial market in this sector kept disappointing Investors, Promoters and existing Producers; a string of bad news / events eroded the trust of the sector players.

Events such as the negative decision of GDF Suez regarding the coal-to-biomass conversion of Rugeley's plant (with an estimated negative impact of more than 800 M euros in investment on the sector); continuous delays in EON's Ironbridge and its import Terminal in Liverpool (leading to an excess of pellets in spot deals and swaps with other Utilities).

Other news such as the Dutch government delays on the new biomass policy; the UK's decision on the ROC and CFD which meant a drop in demand from the Utilities that were planning to co-fire (such as SSE and Scottish Power); the Polish suspension of biomass (effectively eliminating the agro-biomass trade and the few wood pellet deals made in the region). The cumulative effect became a major putt-off for many Promoters in North America and increased the difficulties for existing Producers, namely the Europeans, who are facing higher electricity prices as well raw material shortages and/or price increases.

At the same time, the maturity of the Heating market in countries like Germany, Austria, France, Spain, Italy and, traditionally, the Scandinavian region, generated an increasing volume demand at more generous prices, this in turn created a trend for many wood pellet suppliers to move their production to 6mm EN Plus certified wood pellets, either shipped in Bulk or 15kg bags Palettes.

This is causing a small turmoil in the Market, as many of the traditional suppliers of Industrial Pellets are now converting to Residential Pellets, especially the ones with plants up to 60.000 MT per year capacity. Mid-size plants - about 100.000 MT per year output - will continue to have a presence in both markets but this raises issues of volume fluctuation, due mainly to seasonality and storage limitations, which is generic in the residential market.

A pertinent aspect, in 2013 was the attempt from the Industrial Wood Pellet Buyers (IWPB) to create more standards. This has led to the standard EFET contract (source: EFET) a huge leap forward towards introducing liquidity in the market, with more spot, time spreads and swap deals.

Large plants, namely in North America but also the Baltics and Russia, will continue to target their volumes to the Industrial market.

2014 is shaping up to be a better year, with the likes of several Utilities such Drax (units 2 and 3), Dong (Adore expansion), EON’s Lagerlof and RWE's Lyne mouth, launching their conversion projects. Furthermore government policies have become clearer in both UK and Holland, which in the latter case regenerates the demand in plants like Maasvlakte, EPZ, Gelderland, and Amer. This will fit straight into North America portfolio, leaving small room for European producers.

Additionally, due to poor carbon footprint, the Pacific coast Canadian Pellets will aim more and more towards the South Korea and Japanese markets, which are becoming increasingly interesting both in terms of volume and price.

Combined with the maturity of the Heating market, this expansion of the Industrial volumes will require coordinated actions between Utilities, existing Producers and Promoters, to promote standardization and a balance on the growth in demand and supply and lobbying on National and European policies.

As stated last year, the maturation process of this industry creates this peaks & troughs, waves of enthusiasm and depressive periods, especially if compared with its competitors such as coal & gas.

march 2013: Eon fully converts UK power plant to biomass (Source: www.argusmedia.com)

18 Mar 2013, 3.38 pm GMT

London, 18 March (Argus) — German utility Eon has converted a second unit at its UK Ironbridge power plant from coal to biomass, meaning that the facility is fully converted, despite declining to confirm its plans last year.

The newly-converted unit — unit 1 — is scheduled to have 300MW of capacity available from 23 March, according to the company's generation availability report. Unit 2 has been generating with wood pellets since 21 February at 200MW, but has also ramped up to 300MW availability. The unit's full capacity is 450MW.

“Work is continuing to return the other unit to service following conversion,” Eon said. “The rating and availability will be in line with the Remit publication — currently showing 300MW for each unit.”

Eon announced plans to convert Ironbridge unit 2 in January last year. The utility took both units off line during the conversion but said its priority was to convert one unit only. The extra capacity could add another 1mn t/yr wood pellet demand to UK consumption this year.

Ironbridge will retain flexibility to burn up to 20pc coal, Eon said. The units will each receive 1.5 renewable obligation certificate (Roc) for each MWh of electricity produced until 1 April and 1 Roc/MWh thereafter. But subsidies will fall to 0.6 Roc/MWh from 1 April if it utilises its 20pc coal flexibility.

Eon has no plans to retrofit Ironbridge to allow it to continue generating past 2015 after it has used up its remaining hours under the EU's large combustion plant directive. German utility RWE recently received planning and environmental approval to carry out works to allow its 750MW Tilbury plant, also in the UK, to continue operating.

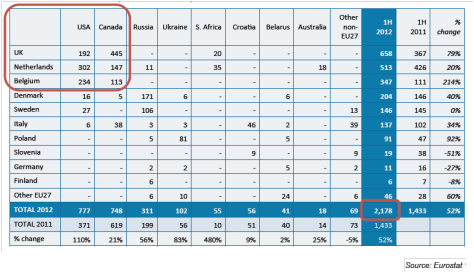

march 2013: European Wood Pellet Demand Trend and Supply from North American Producers!

Based on the statistics by Eurostat:

- In 2012, the large percentage of demand in Europe was driven by UK, Netherland and Belgium compare to Denmark, Sweden and Italy on the other end of the spectrum.

- In comparison to 2011, the wood pellet demand was increased for UK by 79%, for Netherlands by 20% and for Belgium by 214%.

- Canadian and US based producers were the main suppliers of the overall wood pellet to the European market. In comparison to 2011, in 2012 the US based producers experienced 110% increase on the supplied wood pellet and for Canadian producers, the increase in the same period was 21%.

- For UK, Canadian producers were favoured over US ones with twice the supplied volume and for both Netherlands and Belgium; the role was reversed, where US producers supplied twice as much as the Canadian ones.

february 2013: Global Biomass Trade Market Trend Forecast; Are you ready for the future demand?

(source: Based on excerpt form market analysis and presentation by our european affiliate; Wood Pellet Services)

- In comparison to demands in North America, South Korea and Japan, starting in 2015, the demand in Europe is forecasted to be multiple factors of other places globally and will increase exponentially to ten-fold by 2025.

- The demand for Industrial Wood Pellet in 2020 is forecasted to increase exponentially by UK leading the Europe as the main market.

- The largest sources of wood pellet productions are expected to be Canada and USA.

- In a short term, focus is on the major market hot spots in Europe, specially the producers of Energy in Netherlands, Belgium, Germany and France.

february 2013: market outlook for 2013 industrial wood pellets

(source: our european affiliate; Wood Pellet Services)

2012 saw several incidents involving end-user’s plants, namely Tilbury (RWE) and Avedore (DONG Energy). Added to which, the suspension of the Dutch renewable energy incentives, which in turn resulted in the suspension of the use of biomass in the Dutch power plants of GDF Suez, EON and RWE.

The commissioning of EON's plant in Ironbridge in the UK was viewed with relief by producers from North America and Europe (principally from Iberia, Germany & the Baltic).

Yet, the failure to meet the announced completion dates (initially September 2012, then November 2012 and December 2012, now delayed to end February 2013), caused turmoil in the market, bringing uncertainty to the producers.

This resulted in many hundreds of thousands of metric tons being stored throughout Europe, plunging the stop price down to below the 2008 level. Furthermore, the delay in announcing the ROC Bands in the UK caused a fall in the forward price. This in turn caused a slip on the dates of the planned commissioning of UK plants, such as Rugeley (GDF / Mitsui).

With the dual problem of the current excess and future shortages coupled with investors (both producers and end-users) having to either take risks or to wait, with each strategy presenting very different returns, 2013 will be a challenging year.

Existing Producers will (are) suffer(ing) from the logistical issues that the shortage of consumption causes. It is possible that some plants may have to close or suspend production due to cash flow or to high production costs in the face of the (lower) market price.

The sector continues to be a small and relatively immature industry as compared with its competitors, such as coal & gas, and as a result the peaks & troughs are bigger and more destructive.

The future seems bright but still a way to go!

august 2012: DONG Energy: Fire at CHP Avedoere

Unfortunately a serious fire occurred the 12th of August at the CHP Avedoere silo and conveyers system. The fire fighting division, present not far away from the port of Avedoere, attended quickly and used most of the Sunday to bring the fire under control but has not yet ended all investigations. Thankfully no employees or other personnel were injured. The small silo which is the main logistic system to load pellets into the Power Plant were severely struck by the fire and the conveyer system cannot be used to discharge pellets from Port conveyers into the different storages for pellets.

Due to the fire incident DONG Energy may be prevented from receiving any further deliveries of wood pellets. As the fire fighting division is currently conducting further investigations with regards to the scale of the incident and the consequences hereof it is unfortunately not possible to be more specific for the time being. WPS will of course keep updates as DONG Energy reserves the right to claim force majeure.

august 2012: The UK government announces its decision on ROC banding - (Forest Energy Monitor Newsletter, HAWKINS WRIGHT Issued July 25, 2012)

With respect to Biomass, some of the main highlights of the decision by the DECC excerpted from published report by HAWKINS WRIGHT are on:

- Coal-to-Biomass Conversion

- Dedicated biomass power

- Sustainability criteria

click here to read the august 2012 newsletter...

july 2012: It is with great pleasure to announce the formation of private and members-only North America Bio Wood Pellet Consortium networking group:

may 2012: It is a well know fact that in all industries, finance is the fundamental key in securing success for an emerging or expanding business. Undoubtedly, wood pellet industry is not an exception to this global rule.

For any North American producer of wood pellets, securing finance is the essential and focal deciding element for:

- Designing an adequate new production plant or expanding an existing one

- Purchasing the necessary machinery, equipment and replacement parts

- Securing the availability and flow of the raw materials

- Marketing and establishing professional representation in the global market place

- Developing a reliable logistics network or expanding the existing ones for delivering the wood pellets to the end users

Considering the North American open market; it is well understood by wood pellet producers that business initiatives of such magnitude would hardly receive government subsidies. Therefore, securing finance for continuing or expanding a wood pellet operation remains an internal task of a business. Furthermore, it goes without saying that the financial challenge may well hinder the continuation of an existing operation and/or its expansion.

As the senior executive level key players in both the European and North American Wood Pellet markets, this is where our key role in assisting the North American producers of Wood Pellet becomes prominent.

Specifically, our European affiliate, Wood Pellet Services, goes a long way bridge the gap with a two-tier approach of Indirect and Direct Supports.

click here to read the may 2012 newsletter...

march 2012: What is the effect of European regional economic instability on the North American Producers of Wood Pellet?

This has recently been raised as a legitimate concern by some of the North American producers. Without a doubt, when it comes to international trade, one of the main factors in sustained business relations is the regional economic stability of export markets.

Especially at the international level the impact of economic instability in one part of the world is beyond the control of the producer and exporter of a product. This added high risk is naturally a contributing element in withholding the initiation of the key business developments and withdrawing from engaging in contractual agreements.

Having said that, it is notable that the international trade are not decreasing, but is in fact increasing. Why?

The logical answer lends itself to the following key business principles:

- The correlation between the specific market and the region

- The level of familiarity of the producers with the market and its key parameters

click here to read the march 2012 newsletter...

january 2012: What will be the impact on the wood pellet market for European countries to meet their targets of National Renewable Energy Action Plans (NREAPs)?

Based on the the NREAP Bioelectricity targets, pictorially, the electricity generated from solid biomass will increase significantly by 2020...Similar trend will be inevitable for Heating and Cooling from Biomass...

What are the 20-20-20 targets of the EU's Renewable Energy Directive? and who are the major European growth Market for Biomass Heating & Power?

click here to read the january 2012 newsletter...

november 2011: united kingdom announced on October 20, 201 passing a law for subsidizing the wood related biomass products for the power plants. accordingly, Wood Pellet is in the forefront of line of biomass products and the focal point of attention due to its clean energy, refinement and lower transportation costs.

this law will come into effect in the april 2013 and will create a huge demand of Wood Pellets in the volume of more than 15 million metric tonnes per year for main power plants. considering the total demand for all sectors, the annual volume is expected to be much higher.

click here to read the november 2011 newsletter...

october 2011: to meet the exponentially growing demand in europe, we are actively seeking producers of bagged wood pellet for up to the next 10 years. should you be interested in securing long term contracts for europe, please contact us for details.

september 2011: there is an exponential demand forecasted for the european market and our firm is actively seeking north american producers, which will be able to meet the requirement and secure the production for the next 10 years. should you be interested in securing long term contracts for europe, please contact us for details.

september 2011: two major eastern and central canada producers have been successfully represented in European market with long term contracts. this success will pave the way and provide other producers with the potential of securing stable and long term contracts.

august 2011: two major eastern and central canada producers are being successfully represented in European market with long term contracts.

june 2011: bio wood pellet has been launched as a forum for representing the north american producers of wood pellet in the global market.